IRS Identity Protection Pin Help

IRS Identity Protection Pin Help

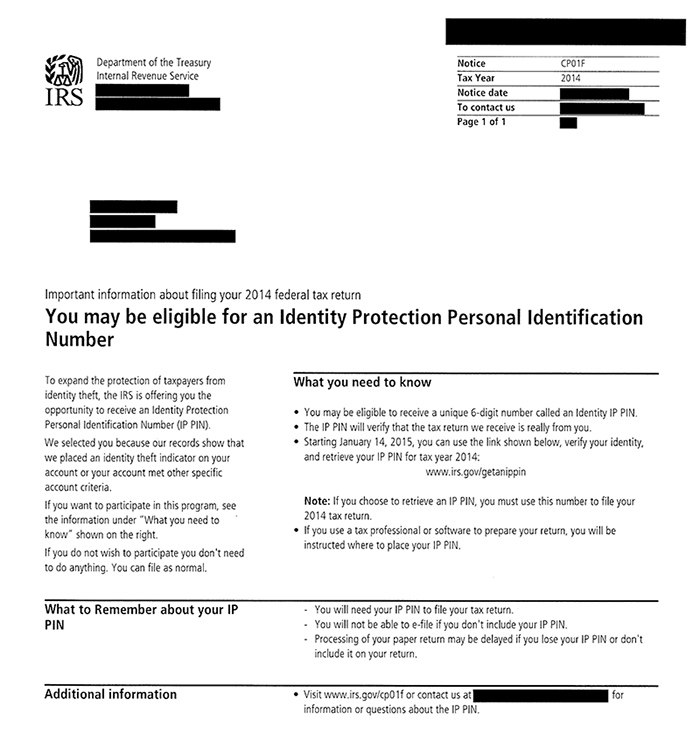

IRS Identity Protection Pin Help. Do you have an IRS IP Pin due to IRS Identity Theft?

How do I get my 6-digit IRS Identity Protection PIN?

You’ll need a 6-digit IRS IP PIN to e-file your 2015 tax return if any of these apply:

- You lost your IRS CP01A notice which contains your 6-digit IRS IP PIN; or

- You used an IRS Identity Protection PIN to file previously but you didn’t receive one from the IRS this year; or

- Your return got rejected with IND-181 from the IRS.

To get your 6-digit IRS IP PIN, go to the IRS Get An Identity Protection PIN webpage. You’ll need access to an email account and you’ll also have to answer a series of question to validate your identity.

See also the Frequently Asked Questions about the IRS IP PIN program.

Is my 6-digit PIN the same thing as the 5-digit PIN?

No. Your 6-digit Identity Protection PIN (IP PIN) is only issued in cases of identity theft.

You won’t be able to enter it in the Electronic Filing PIN nor the Self-Select PIN fields, both of which only have room for 5 digits.

Where do I enter my 6-digit IP PIN?

In TurboTax, your 6-digit IP PIN is entered in a different place than the similar-sounding (but completely unrelated) 5-digit Electronic Filing PIN.

Instructions

- Open your tax return software.

- In the upper right corner, search for IP PIN (2 words, upper- or lower-case) in the search box.

- Your Tax Software will take you to the Identity Protection PIN screen. Answering Yes will open a field where you can enter your 6-digit IP PIN.